In India, the whole borrowing money scenario has changed remarkably within the past few years. The long queue at banks, multiple document submissions, and waiting for the approval that would take forever are now part of the past. The technology today has transformed the entire lending process to be simpler, faster, and more accessible.

A significant role in this transition has been played by the online lending platforms and 0% interest loan appssuch as Viva Money. Financial convenience has been delivered right up to people’s mobile phones. People can now borrow money with just a few clicks, whether it be for bill payments, emergencies, or daily expenses.

The Shift from Traditional Lending to Digital Platforms

Banks were always very secure about lending money. But the long process, accompanied by a huge pile of paperwork, can sometimes be intimidating. The requirements were so strict that many people, especially young professionals and small business owners, found it difficult to meet them strict requirements.

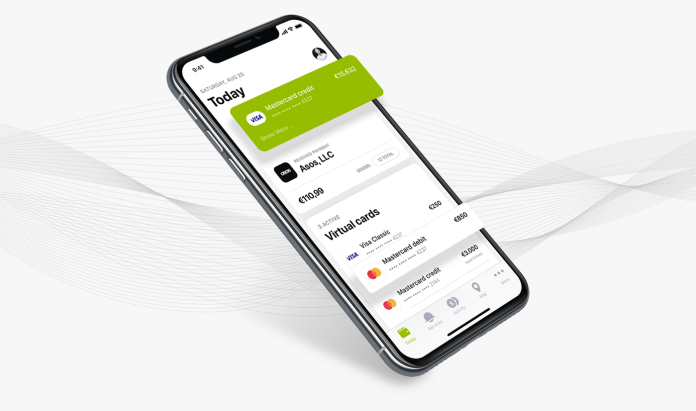

Digital apps, on the other hand, have turned the whole thing upside down. With applications like Viva Money, borrowers do not have to go to a bank or fill out multiple forms. They can submit their application online, have their details verified digitally, and get instant approval. This method is not only time and effort-saving but also guarantees security and transparency.

The Power of Instant Approvals and Quick Disbursement

One major benefit of using applications such as Viva Money is the quickness of their operations. The process of traditional loans could be stretched over several days or even weeks. In contrast, the approval of digital loans takes only a few minutes.

Smart technology is utilized by such apps for identity verification, checking creditworthiness, and confirming eligibility in no time. The moment a user gets approved, the money is usually transferred to his or her bank account directly, within minutes. The easy and quick process makes it perfect for emergencies such as unexpected medical expenses or urgent travel costs, where access to money promptly is very important.

For instance, if a person suddenly needs money for a hospital bill, he or she can turn to a digital loan app rather than waiting for help from relatives or informal lenders. They can apply and get funds within minutes using a reliable loan app.

Transparency and Control at Your Fingertips

A further factor that is driving people towards digital borrowing is the increasing demand for transparency. Borrowers want to know the total loan amount, the applicable interest rates, and the repayment schedule. Apps like Viva Money make sure to exhibit all the mentioned information clearly, even before the approval.

Moreover, the users have the option of monitoring their loan status, repayment dates, and the availability of credit limit via the app itself. This gives them more control and awareness over their finances. Unlike traditional systems, where you had to rely on a loan officer for updates, now everything is visible on your phone.

Security has also improved with these platforms. Digital apps use encrypted systems and follow RBI guidelines to ensure user safety. The entire process, right from KYC verification to loan disbursement, is protected and transparent.

Flexibility that Fits Modern Lifestyles

The new generation values flexibility. People want financial options that adapt to their lifestyle, not the other way around. Apps like Viva Money make this possible by offering features like flexible repayment options, low processing time, and also 51-day interest-free grace period.

This approach allows users to borrow money only when needed and repay it at their own pace. Whether it’s paying rent, managing wedding expenses, or buying a gadget, these flexible credit options simplify financial decisions.

Moreover, since everything is digital, there’s no need for physical documents or visits. The entire borrowing experience happens within a single app, giving users both comfort and confidence.

Empowering Financial Inclusion Across India

India’s digital lending revolution is not just about convenience; it’s about inclusion. Many people are using smartphones for financial access for the first time. For them, borrowing through an app is often easier than dealing with traditional banks.

Apps like Viva Money are helping bridge this gap. By using simple interfaces, regional language support, and instant digital verification, they make borrowing accessible to everyone. This not only empowers individuals but also boosts the overall digital economy.

As more people experience smooth and transparent lending, financial awareness is also improving. Borrowers are learning to track credit scores, understand interest rates, and manage repayments responsibly.

The Future of Borrowing in India

The rise of Viva Money has been a very clear sign of the fast adoption of financial technology in India. The future of loans will be determined by the factors of innovation, trust, and accessibility.

We are approaching an era when consumers will rely on their smartphones for all money-related activities like saving, spending, and borrowing. Instant approvals, paperless processes, and flexible repayment models will become standard practice rather than exceptions.

This digital transformation is also pushing banks to upgrade their technology and invest in providing more transparent and quicker services. As competition grows, borrowers will continue to benefit from better interest rates and smoother user experiences.

Final Thoughts,

In the past, taking a loan was a complicated, stressful, and lengthy process. With digital platforms such as Viva Money, it now feels effortless, secure, and transparent. These applications are making finance smarter and simpler to handle through instant approvals and flexible repayment options.

Money apps have been a blessing in disguise for the Indian population that is getting used to convenience as a way of life. They are not only changing the borrowing landscape of the country but also transforming the meaning of financial empowerment.

![F95Zone Register and login Process Step by Step [f95zone.to] F95Zone](https://moneypip.org/wp-content/uploads/2021/01/F95Zone-100x70.jpg)